European Automobile manufacturers

REGARDING Erik Jonnaert

Erik Jonnaert is Secretary General associated with European Vehicle Manufacturers’ Association (ACEA). Mr Jonnaert started his job with the Linklaters law practice. He consequently joined Procter & Gamble, where he worked for 25 many years in public places and regulatory affairs, communications and stakeholder relations. Before joining ACEA, he had been Procter & Gamble’s vice-president for External Relations in European countries and Asia. Mr Jonnaert is a graduate of Harvard Law School.

REGARDING ACEA

The European vehicle brands’ Association (ACEA) signifies the 15 European automobile makers at EU degree, offering technical and commercial expertise for the policy-making procedure. ACEA’s users tend to be: BMW Group, DAF Trucks, Daimler, Fiat Chrysler Automobiles, Ford of European countries, Hyundai Motor European countries, Iveco, Jaguar land-rover, Opel Group, PSA Group, Renault Group, Toyota Motor European countries, Volkswagen Group, Volvo Cars, and Volvo Group.

Anastasia Varnavskaya, Head of Automotive Portfolio, Adam Smith Conferences: helping aided by the improvement a competitive automotive business is one of the cornerstones of one's organisation. What does it imply become competitive in 2016? Has actually it changed throughout the last ten years?

Erik Jonnaert, secretary-general for the European Automobile brands’ Association (ACEA): Indeed, certainly one of ACEA’s primary goals would be to fortify the global competition regarding the European automobile industry. We do this by engaging in dialogue aided by the European establishments and other stakeholders in order to enhance knowledge of industry-related dilemmas, and also to add constructively to efficient plan and legislation. Inside your it is necessary for us working with these people, because we truly need an enabling policy framework when we are dedicated to revitalizing growth and jobs in Europe.

Among the key paths towards strengthening our competitiveness is fostering development. Considering that innovation is market driven, the automotive industry requires the flexibleness to operate a vehicle it ahead, with policies and laws that encourage it. Plan producers tend to be in an original place to aid committed automotive initiatives and research that will further advance car connectivity, environmental overall performance and protection.

Secondly, we need to ensure that regulating requirements remain balanced and proportional whenever we like to retain our business’s competition in years to come. The automotive industry has already been probably the most regulated areas in Europe, subject to around 80 EU Directives and over 70 intercontinental UNECE agreements. Regulations associated with protection, environmental surroundings and taxation have already included significantly toward production price of a car or truck.

Future regulatory measures should-be more efficient and balanced, whilst safeguarding industry competition. As an example, when it comes to decarbonisation our business has decreased CO2 emissions considerably and it is committed to do more, however the general expenses of decreasing emissions must certanly be comparable and proportionate across all sectors, in Europe versus all of those other globe. That’s the reason why ACEA demands a holistic method, addressing all modes of transportation – including atmosphere, maritime and railway – and all sorts of of Europe’s manufacturing areas. For more information about decreasing CO2 emissions more effectively, i would suggest everyone to check out: www.reducingCO2together.eu.

Anastasia Varnavskaya: whenever do you think the EU car market will attain pre-crisis levels once more?

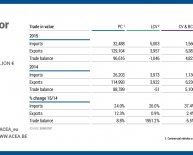

Erik Jonnaert: even though the EU car market continued its course of recovery a year ago, whenever around 13.7 million vehicles had been offered, it is vital to recognize that we have been however far underneath the pre-crisis degree of 15.5 million products. At the moment, ACEA forecasts growth for EU traveler car sales around 5per cent for 2016. With regards to products, this will indicate over 14 million vehicles sold. Very a feat, but nonetheless far-removed from peak sales in 2007. Exactly the same applies to manufacturing. Even though number of both traveler vehicles and commercial cars manufactured in European countries increased by over 7% this past year, we’re however unable to come near pre-crisis amounts. The situation in Europe is still very different from what we have seen in the usa within the last few years, where the car business features managed to fully recover from the crisis.

Something that could turn the tide is TTIP. This trade arrangement between the United States therefore the EU is currently under settlement, and would offer great market options for Europe’s vehicle producers. Hence, we truly need plan manufacturers to guard the good, however fragile, momentum of our industry by continuing to stand by the concepts of free trade. Not just would TTIP offer our industry a boost, although trade contract also presents an unprecedented opportunity for Europe’s economic climate at large – exciting EU production and trade.

Anastasia Varnavskaya: