Australian Auto industry

The world is within the grip of financial obligation and deflation, and firms that cannot match the rigours of falling costs are dropping because of the roadside, writes Alan Kohler.

The world is within the grip of financial obligation and deflation, and firms that cannot match the rigours of falling costs are dropping because of the roadside, writes Alan Kohler.

The Australian car industry had not been killed by the large currency. It really is a target of just what IMF main Christine Lagarde calls the ogre of deflation.

Automobile prices in Australian Continent dropped 2.8 percent a year ago based on the abdominal muscles, although the dollar depreciated 15 %, therefore it was not the dollar.

The clue to your issue lies in that so many people will totally lose their particular jobs as a consequence of a's closure: contemporary car industrial facilities use robots, maybe not folks. Near a factory in Japan and no workers flow from the gates telling TV digital cameras exactly how sad they're.

It's not just cars: many prices are dropping, maybe not rising.

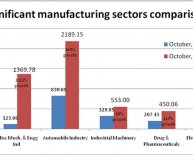

Inflation kicked up in the December quarter, nevertheless costs of clothes, computers, TVs, cars, gasoline and pharmaceuticals all fell. Australian expenses, meanwhile, all moved up. Earnings rose 3 % and property costs rose practically 10 %.

Without a perplexing (into RBA) boost in fruit, vegetable and hotel costs, Australia is flirting with deflation exactly like Europe, America and Japan, where in actuality the central financial institutions have actually cut interest levels in terms of they're going to go and are now printing cash.

Costs are attempting to fall because automation means it costs less and less to produce things. Organizations that can't maintain the rigours of dropping prices themselves fall because of the roadside.

The latest age of sprinting technical development, now including the marvels of 3D printing, plus too much capability left from the GFC, have actually created what IMF primary Christine Lagarde called at Davos the "ogre of deflation".

Yesterday evening the newest seat for the Federal Reserve Board, Janet Yellen, in her own first congressional testimony, recommitted the Fed for you to get inflation support to 2 per cent and thus are maintaining interest levels where they truly are "well past" the time unemployment falls below 6.5 percent.

Her testimony forced markets greater, like the Australian buck. So main banking institutions tend to be succeeding in enabling some costs up, for example stocks and home, and for the moment they truly are deciding for the.

It's not only brand new technology and automation being driving down consumer rates the world over.

Debt can be deflationary, because it increases offer and lowers need. Indebted organizations have a tendency to create more to keep solvent and indebted consumers and governing bodies purchase less to pay off debt.

Also, the internationalisation of China's money, the renminbi, is financing various other establishing nations like Vietnam, Bangladesh and Cambodia to industrialise more cheaply, flooding the entire world with yet more low priced products.

And product costs are depressed, unlike various other tradable possessions, because of the huge assets in mines and power production facilities within the last decade.

The world's brand new business elite are not industrialists or bankers, however the great price-cutters associated with the age, corporations like Google, Amazon, Apple.

This brand new variety of corporate predators is rich since they're operating down costs, including in Australian Continent. Google, Facebook and Twitter have destroyed the traditional marketing and advertising market; Amazon has damaged retail margins; Apple's iTunes, with Spotify and BitTorrent, has collapsed the price of music and flicks.

Everyday affordable prices are good, we'd all concur, so just why are frontrunners like Christine Lagarde scared of it, and exactly why is Janet Yellen attempting therefore desperately for rising prices up?

Because financial obligation and deflation go into a spiral: reduced prices boost the worth of cash - and therefore debt - and much more financial obligation suggests more production much less demand, therefore even more deflation, and so forth.

So that the ogre that stalks the whole world isn't deflation, but financial obligation.

The clear answer? Even more financial obligation, obviously. The central bankers want to conjure up more need by decreasing the cost of credit to zero and encouraging people to remove it their fingers. In the usa and Japan these are generally even materialising cash therefore it is lent, all to no avail. All of the imprinted cash is sitting unlent in bank reserves.

It has already been taking place for 5 years, however rising prices worldwide will continue to fall, except in Australia, where fresh fruit and vegies have conserved your day the moment, thanks to the climate.